25+ Fannie mae mortgage rates

As a share of median household income our estimate of the principal and interest payment on a median-priced home is still just below the highest since 2005. Ineligible Project Characteristics Condo Project Type.

End Of Qe 4 Fed S Repos Drop Below Oct 2 Level T Bills Balloon Mbs Fall Total Assets Down To Dec 25 Level Wolf Street

Effective with the third quarter 2019 dividend period the Enterprises were not required to pay further dividends to Treasury until they accumulated over 25 billion in net worth at Fannie Mae and 20 billion in net worth at Freddie Mae.

. 25 34T3-06 Reporting a Transaction 89 Discontinuance of Mortgage Insurance 01182017. New projects where the seller is offering sale or financing structures in excess of Fannie Maes eligibility policies for individual mortgage loans. Mortgage rates which have risen significantly just since the start of 2022 may be set to do an about-face in 2023.

Fannie Mae chief economist Doug Duncan believes the 30-year fixed rate will be 28 through 2021 and reach 29 in 2022. To receive the 025 interest rate discount borrower or members of borrowers household must have. Fannie Mae HomeReady Mortgage.

30-year mortgage rates. 34T5-02 Calculations Related to Pass-through Rates 06122019 34T. Fannie Mae and Freddie Mac the agencies that administer most of the conventional loans in the US charge loan-level price adjustments or LLPAs.

VA Streamline Refi 2022 March 25 2022 FHA. 34TReporting a Mortgage Loan Liquidation to Fannie Mae 34T. Is the 3-down mortgage via Fannie Mae and Freddie Mac better.

Freddie Mac and the National Association of Homebuilders expect mortgage rates to be 3 in 2021 while the National Association of Realtors thinks it will reach 32 and Wells Fargo thinks rates will be 289. Thanks to this backing VA mortgage rates are often around 25 basis points 025 below rates for a comparable conventional loan. According to the Annual Report to Congress filed by the Federal Housing Finance Agency over a span of 37 years from 1971 through 2007 Fannie Maes average annual loss rate on its mortgage book was about four basis points.

Mortgage rates are up about 235 basis points from a year earlier and house prices have appreciated on an annual basis by 194 percent through Q2 according to the Fannie Mae House Price. The share who think mortgage rates will stay the same increased from 21 to 25. A Fannie Mae forecast sees 30-year rates averaging 45 for all of next year.

Compare current mortgage interest rates and see if you qualify for a 25 interest rate discount. Such as Fannie Mae HomeStyle loan or FHA 203k. A jumbo mortgage is in excess of FHFA standards typically starting around 650000 and cannot be backed by government-sponsored enterprises like Fannie Mae or Freddie Mac.

Timeshare fractional or segmented ownership projects. If youre borrowing money at a 25 percent interest rate youre going to pay far more. The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022.

Fannie Mae predicts 272 trillion in mortgage originations in 2021 and 247 trillion in 2022. Loan Limits for. Mortgage Rate Expectations.

The GSE business model has outperformed any other real estate business throughout its existence. Losses were disproportionately worse. Inflation continues to affect 30-year fixed mortgage rates which rose to an average 602 percent in Bankrates weekly survey of big lenders.

The percentage of respondents who say mortgage rates will go down in the next 12 months increased from 6 to 11 while the percentage who expect mortgage rates to go up decreased from 67 to 61. Find average mortgage rates for the 30 year jumbo fixed mortgage from Mortgage News Daily and the Mortgage Bankers Association. 525--003 309 216.

Contact a Mortgage Loan Officer today.

End Of Qe 4 Fed S Repos Drop Below Oct 2 Level T Bills Balloon Mbs Fall Total Assets Down To Dec 25 Level Wolf Street

Calculated Risk December 2012

2

Pin On Real Estate And Local Vegas Info

End Of Qe 4 Fed S Repos Drop Below Oct 2 Level T Bills Balloon Mbs Fall Total Assets Down To Dec 25 Level Wolf Street

2021 Housing Forecast Infographic Housing Market Real Estate Marketing Real Estate Infographic

What Is The Difference Between The Kentucky Freddie Mac Home Possible And The Fannie Mae Home Ready Loan Program Fannie Mae Kentucky Home Loans

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Is Now The Right Time To Buy A House

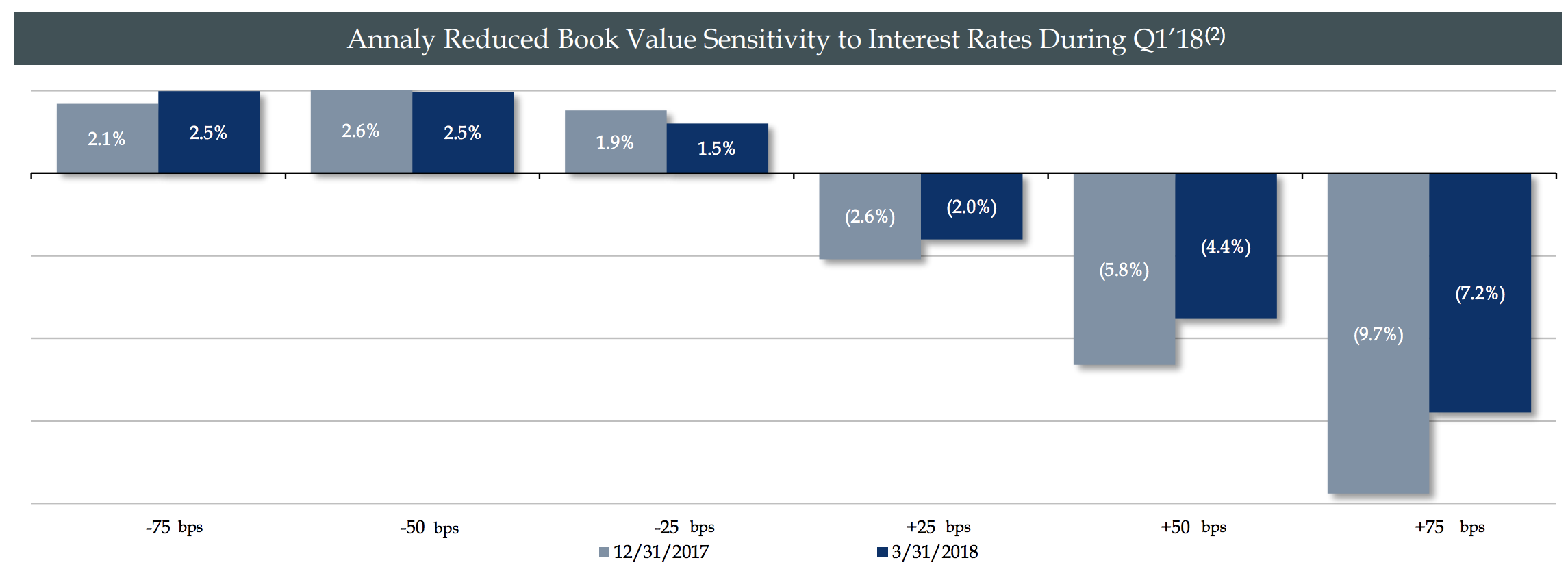

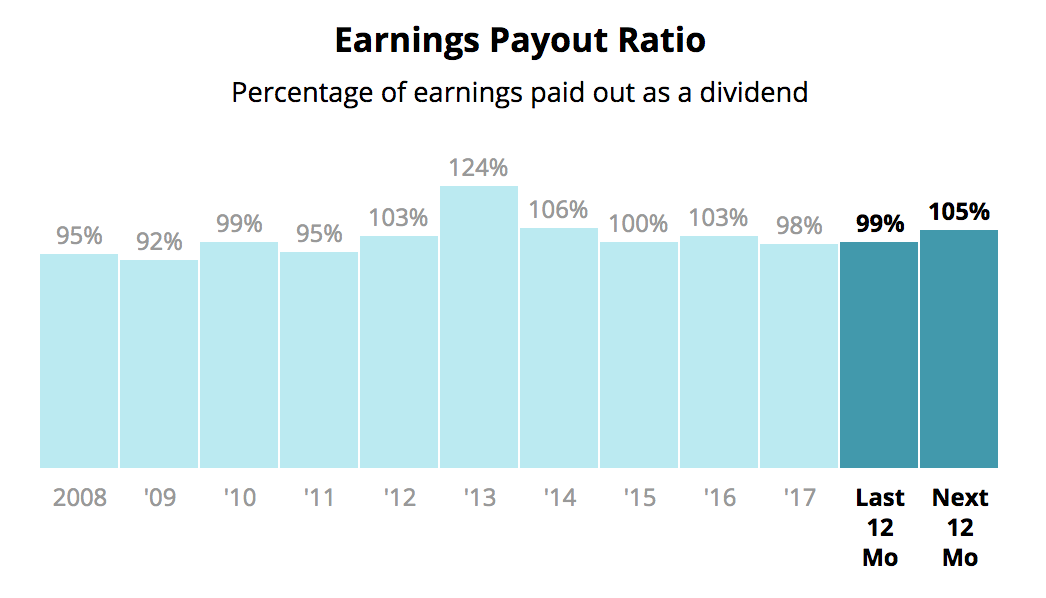

A Guide To Investing In Mortgage Reits

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding

Fannie Mae Homeready Mortgage Loan Global Integrity Finance

A Guide To Investing In Mortgage Reits

End Of Qe 4 Fed S Repos Drop Below Oct 2 Level T Bills Balloon Mbs Fall Total Assets Down To Dec 25 Level Wolf Street

The Doomsday Warnings About The Us Housing Market Are Getting It Backward Housing Market 30 Year Mortgage Business Insider

Tm2034845d13 425img012 Jpg

Calculated Risk December 2012